Announcing Upgrades to Bitcoin-Backed Loans: New Rates, Lower Minimums, and No Maximums

Live from the 2025 Bitcoin Conference: Strike unveils tiered rates starting at 9.5% APR, loan amounts from $10K, no maximums, multiple loans, and 1,500 bitcoin treasury

Strike Team

May 29, 2025

Today, we’re excited to roll out a major upgrade to one of the most powerful features we’ve ever built at Strike: bitcoin-backed loans. This update includes:

- A new tiered interest rate model, with single-digit rates starting at 9.5% APR

- Lower minimums, with loans starting at $10,000 in select states

- Expanded loan sizes, with no maximum

- The ability to have up to three active loans at a time

Since launching earlier this month, we’ve seen incredible demand from customers using their bitcoin to unlock new financial opportunities, without selling a single sat. We’re excited to keep expanding the tools and features that make that possible. Get a bitcoin-backed loan.

We’re also proud to announce that Strike has added to our corporate treasury which now sits at approximately 1500 bitcoin. This doubles down on our long-term commitment to Bitcoin and solidifies our position as one of the top 20 largest corporate bitcoin holders in the world.

Get a loan starting from $10,000

We’ve expanded our loan range to make bitcoin-backed borrowing more accessible and better aligned with your needs. Loan amounts now start at just $10,000 in select U.S. states, with availability varying by location. On the other end, we’ve removed the maximum, allowing individuals and businesses to borrow any amount—unlocking more of their bitcoin’s value without selling.

Whether you’re covering a short-term expense or financing something bigger, you can now borrow on terms that match your goals.

To access loans greater than $5 million, reach out to private@strike.me. Minimum loan amounts vary by state for individuals and businesses.

Borrow smarter with tiered interest rates

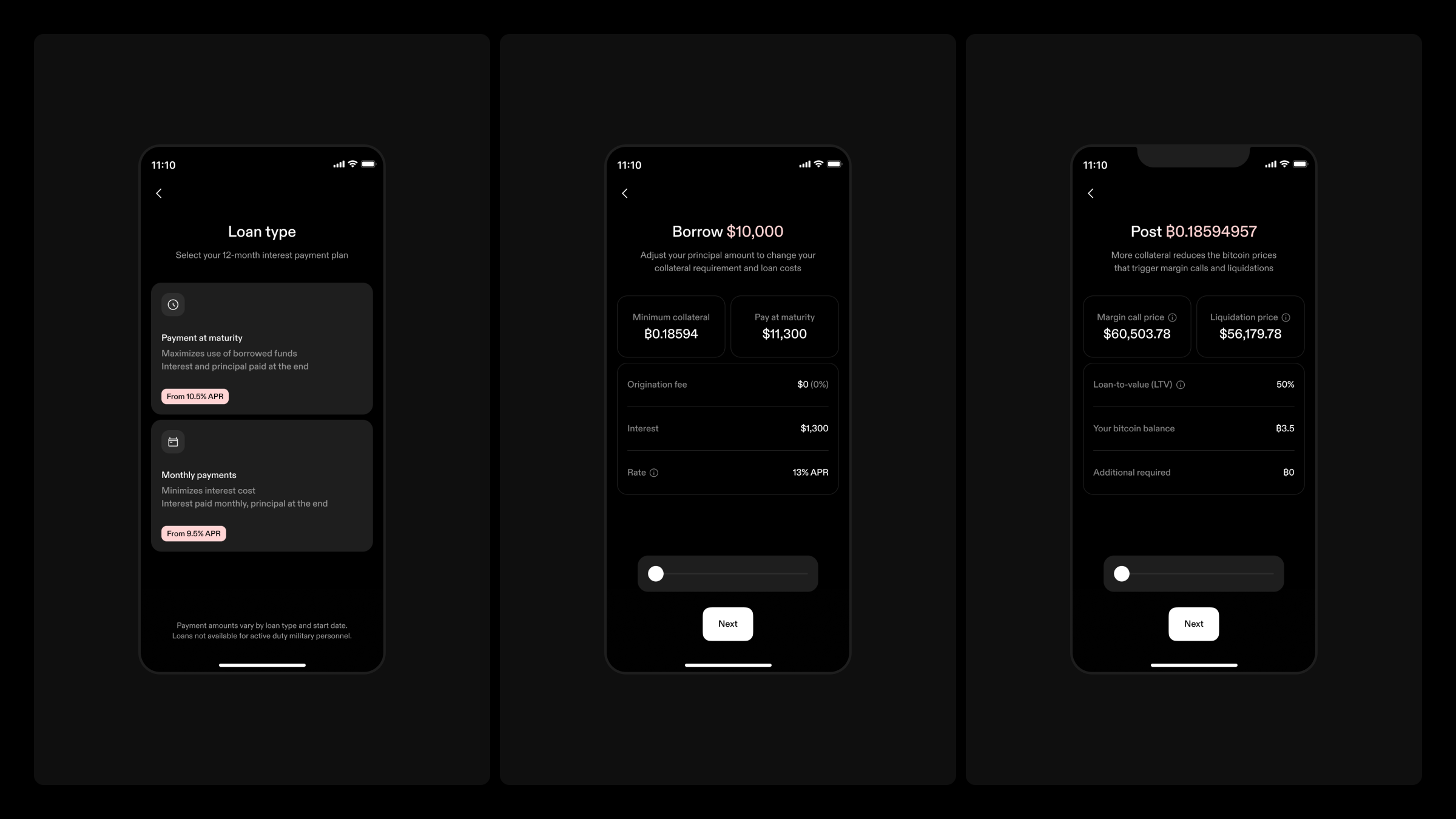

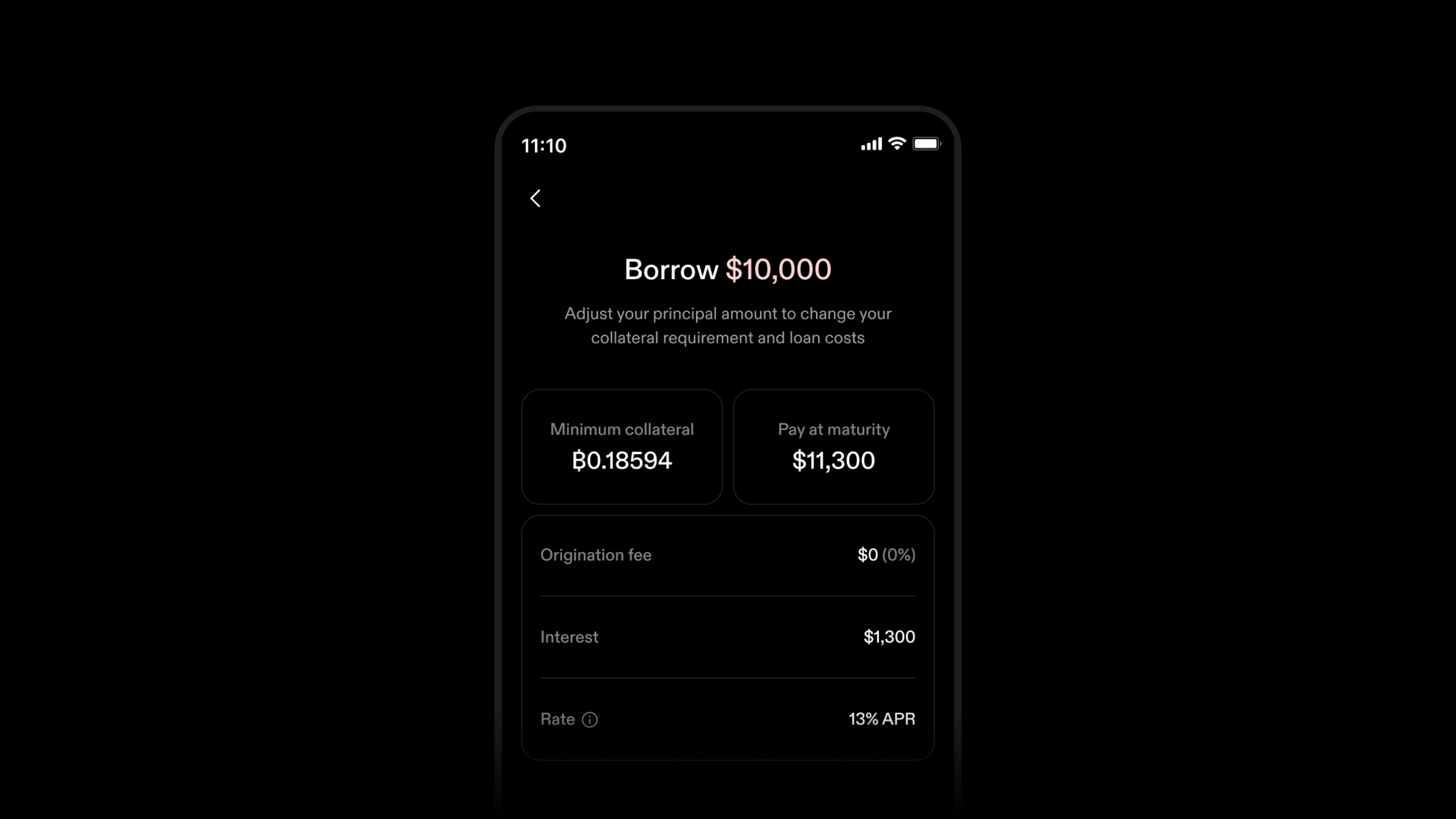

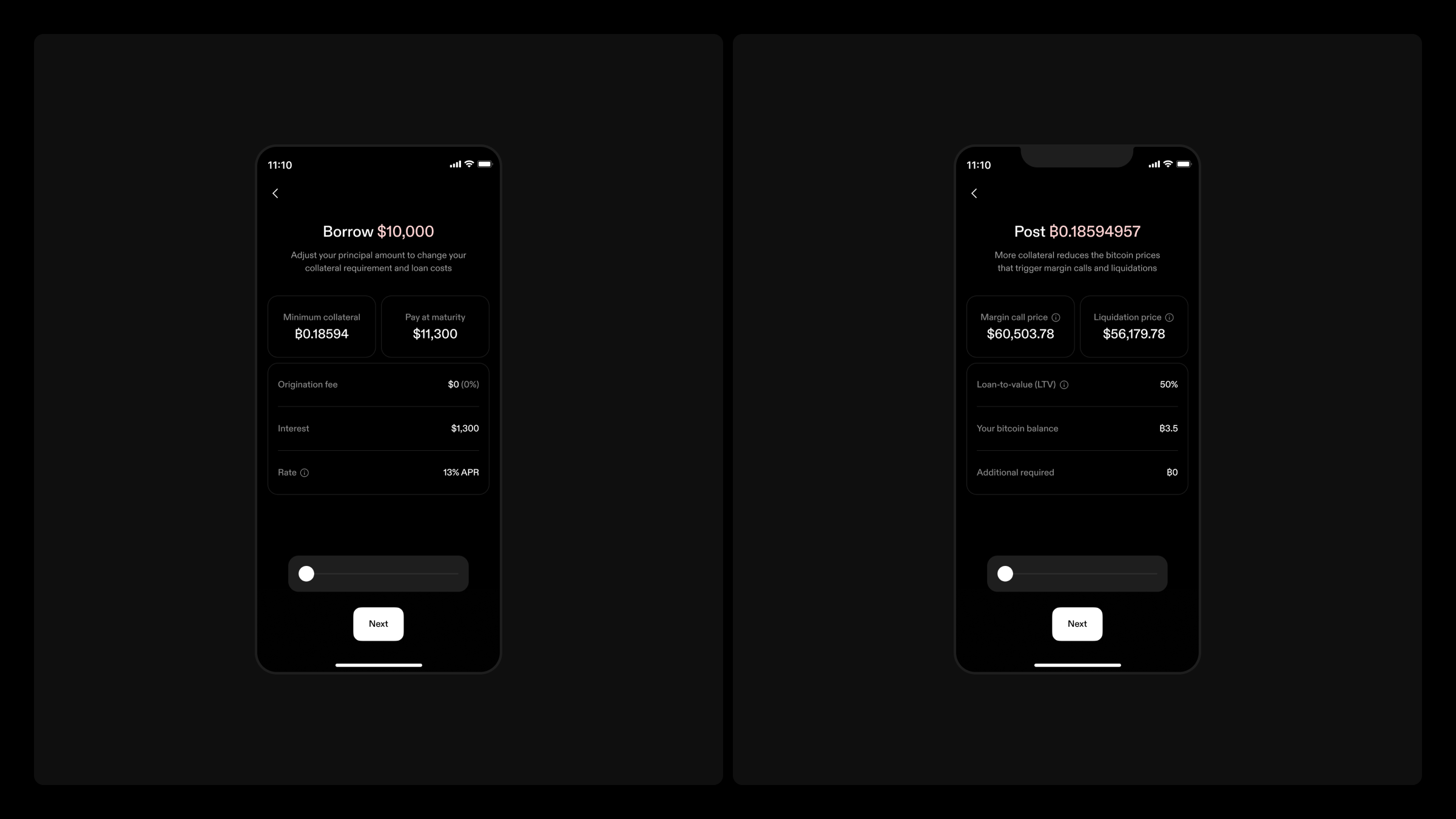

Our new rate model is based on your loan size, giving you more flexibility and efficiency when borrowing against your bitcoin. You can now get a 12-month loan starting at 9.5% APR, with no origination fee.

Strike bitcoin-backed loans currently offer:

- Loans starting from $10,000, no maximum (for loans above $5,000,000 reach out to private@strike.me)

- Interest rates starting at 9.5% APR

- No origination, early closure, or early repayment fees (liquidation fees may apply)

- The option to pay interest monthly or at maturity

- A maximum initial loan-to-value (LTV) of 50%

- Option to add collateral anytime to lower your LTV

- The ability to have up to three active loans at a time

Everything is customizable inside the app. Learn more about our current terms and interest rates in our FAQs.

Open multiple loans at a time

You can now have up to three active bitcoin-backed loans at a time directly in the Strike app. Whether you're funding separate goals, managing risk across different loans, or borrowing at different times, multiple loans give you more control with fewer constraints.

With multiple loans, you can:

- Open loans for different purposes and track them independently

- Lock in a low rate on an existing loan while taking advantage of new terms

- Access more liquidity without closing or restructuring existing loans

Learn more about opening multiple loans.

Same experience, greater flexibility

Bitcoin-backed loans let you unlock your bitcoin’s buying power without selling. By using bitcoin as collateral, you gain access to cash while keeping exposure to long-term upside. Here’s what Strike’ bitcoin-backed loans offer:

- Open a loan in minutes and access funds within one business day, no credit check required

- Customize your loan with dynamic collateral and flexible repayment

- Track loan health in real time, get alerts and request support in-app

- Bitcoin collateral is held by Strike or transferred to one of our trusted capital providers, where it is securely held in a segregated wallet and not re-hypothecated.

Get a bitcoin-backed loan

Bitcoin-backed loans are currently available to eligible customers in select U.S. states, now including Maine and Maryland. If you're eligible, you’ll see the Bitcoin-backed loans card in your app’s Cash tab. Tap it to get started.

Make sure your app is updated and your account is verified. Get started.

What’s next?

The bitcoin-backed loan space is still in the early stages and there is still room to grow. We’re actively working on:

- Expansion to more U.S. states and international markets

- Collateral withdrawals

- Loan rollovers

- Proof-of-reserves–backed lending

These improvements take time, but our roadmap is clear: build financial tools that give Bitcoiners more utility, more options, and more freedom.

Building the future on Bitcoin

Today, we’re also proud to share that Strike has added to our corporate treasury which now sits at approximately 1500 bitcoin, placing us among the top 20 corporate holders globally.

This move reflects our deep conviction in Bitcoin as the financial foundation of the future. Bitcoin doesn’t just power our products, it powers our business, our operations, and our long-term strategy.

Looking to integrate bitcoin into your company’s financial strategy? Strike helps businesses buy and borrow against bitcoin to power growth and manage treasury with a bitcoin-native approach. Learn more or sign up for a Strike Business account.

Thanks

To our customers, partners, and the Bitcoin community, thank you. Your support, feedback, and trust are core to everything we do.

We’re focused on delivering tools that bring real-world utility to Bitcoin, whether you're saving, spending, getting paid, or borrowing. We’re excited to keep building with you.

Watch the full announcement from Strike CEO Jack Mallers at the Bitcoin 2025 Conference in Las Vegas.

© 2025 NMLS ID 1902919 (Zap Solutions, Inc.)